Quick Online Short-term Loans

Get a quick online loan with approval on the same day for amounts up to R40,000. The interest rates are low, starting from 12%, and you can pay it back over a flexible period of up to 24 months. It’s a popular choice for people in South Africa looking for a small loan.

Get Your Money Online on the Same Day, No Credit Check!

A short-term loan is money you can borrow to help with things like paying bills or buying groceries.

You can get this money quickly, often on the same day you apply. And the best part is, you can do it all online without much hassle.

Explore Loan Options and Compare Rates

🧐 Short-Term Loans Online in South Africa

📝 Short-term loans in South Africa are like a quick solution to get money when you need it urgently. People also call them payday loans. These loans come in handy when you have unexpected expenses and need cash right away. They’re a popular choice for dealing with sudden financial needs.

🧐 What You Should Know about Short-Term Loans

📝 Before you decide to get a short-term loan, it’s important to know the good and not-so-good things about it. Take some time to understand how these loans work, the basic details about them, and check out other choices you might have. This way, you can make sure it’s the right decision for you and find the best way to get the money you need.

📝 Short-term loans are designed to provide quick access to cash, addressing immediate financial needs and emergencies. Banks and online loan providers offer these loans, catering to small and medium financial requirements. However, there are important considerations to bear in mind.

🧐 What qualifies for short-term loan approval?

📝 Short-term loans typically have less stringent eligibility criteria compared to long-term loans. While credit checks are less common, proof of the ability to repay, often through monthly salary, is usually required. Some lenders even offer bad credit loans without prior credit checks.

🧐 Cost Considerations

📝 Short-term loans, despite their convenience, come with a significant cost. The annual percentage rate (APR) for these loans is usually high, often several hundred percent. Borrowing charges, additional fees, and charges may contribute to the overall expense, making them one of the more costly forms of credit.

🧐 Risks and Dangers

1️⃣ High-Interest Rates

The interest rates on short-term loans can be exceptionally high, creating a financial burden at the end of the repayment period.

2️⃣ Not for Long-term Use

While suitable for addressing immediate needs, relying on short-term loans consistently can lead to an increase in overall debt, making them an impractical solution for long-term financial stability.

3️⃣ Consequences of Non-repayment

Failure to repay short-term loans on time can harm your credit score, potentially leading to debt collection, credit bureau reporting, and even legal action.

🧐 Getting Short-term Loans from Banks

📝 Traditional bank loans may be challenging to secure, especially with a poor credit score. However, short-term loans from banks in South Africa are generally more accessible and may carry lower interest rates. It’s crucial to understand that even bank-provided short-term loans share similarities with other types of short-term financing.

🧐 Saving Money on Short-term Loans

To mitigate the financial impact of short-term loans, consider:

- Renegotiating payment plans with lenders.

- Exploring consolidation loans for existing debts.

- Exploring peer-to-peer lending options.

- Opting for traditional personal loans with longer repayment periods.

🧐 Challenges in Repayment

📝 Short-term loans can be challenging to repay due to the lump-sum nature of payments. Banks may require asset security, increasing the risk of loss in case of default.

🧐 Risks and Alternatives

📝 All debt options, including short-term loans, carry risks. Efficient use of these loans is crucial. Building an emergency fund, maintaining a credit card for emergencies, and borrowing responsibly are alternatives to relying solely on short-term loans.

🧐 Benefits of Short-term Loans

- Quick Access: Short-term loans provide rapid access to funds, often within minutes to 24 hours.

- Immediate Relief: These loans can cover emergencies or bridge financial gaps until the next salary.

- Limited Indebtedness: Borrowers are committed for a shorter period, typically one to six months, preventing long-term financial entanglement.

While short-term loans offer quick solutions, understanding their costs, risks, and exploring alternatives is essential for responsible financial management.

Short-term Loan Calculator

🙋♂️ Lenders for Short-term Loans

-

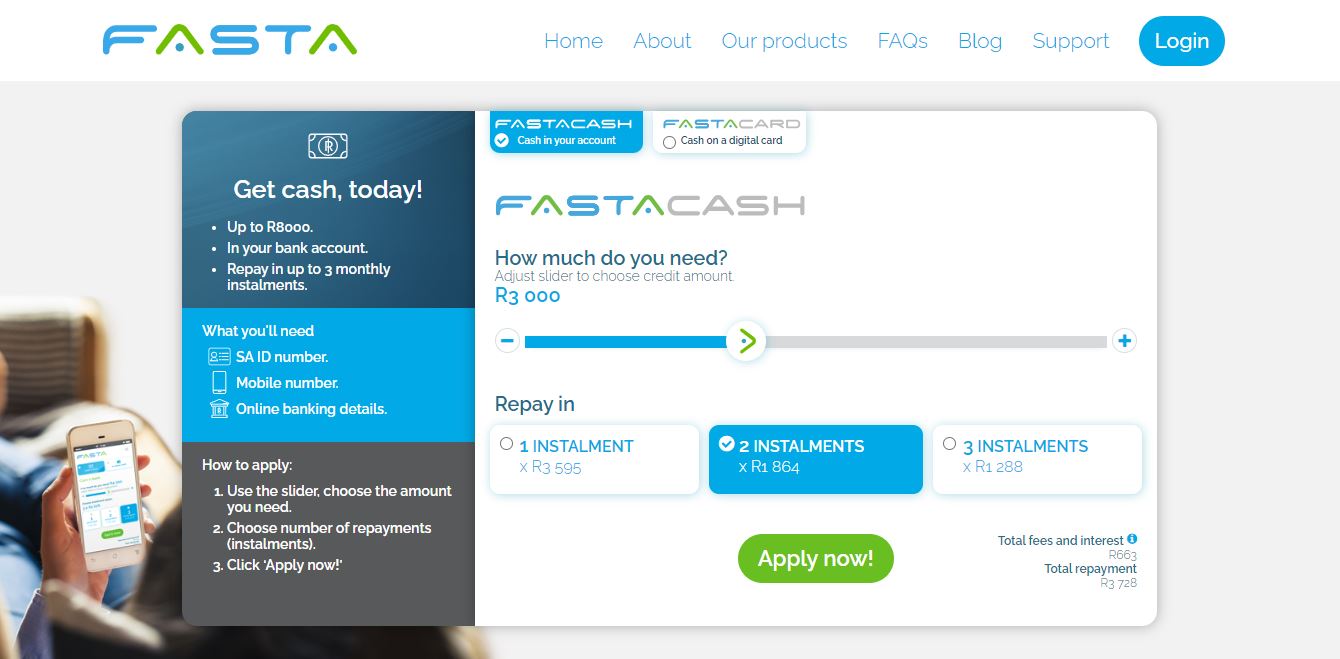

Fasta Loans

- Loans up to R8,000

- Term up to 3 months

- Approval in minutes

-

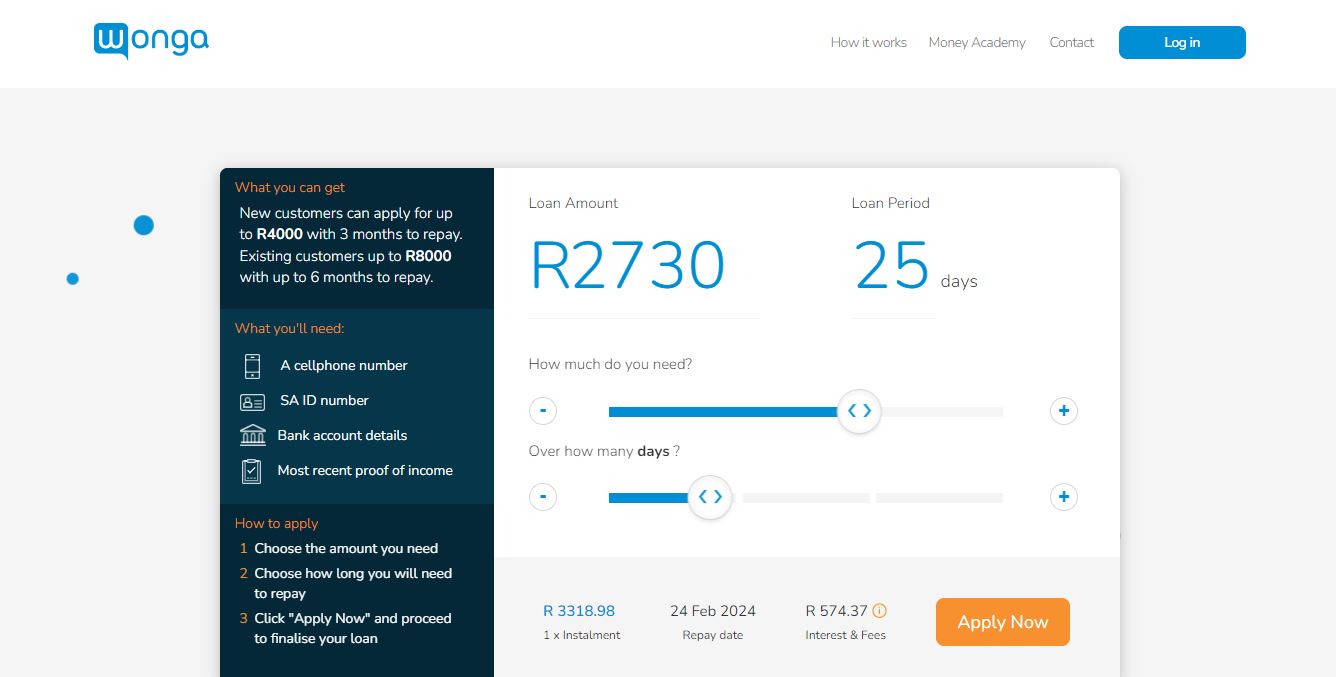

Wonga

- Loans up to 8,000

- Term up to 12 months

- Flexible interest rates

-

Finchoice

- Loans up to R40,000

- Term up to 24 months

- Interest up to 24%

-

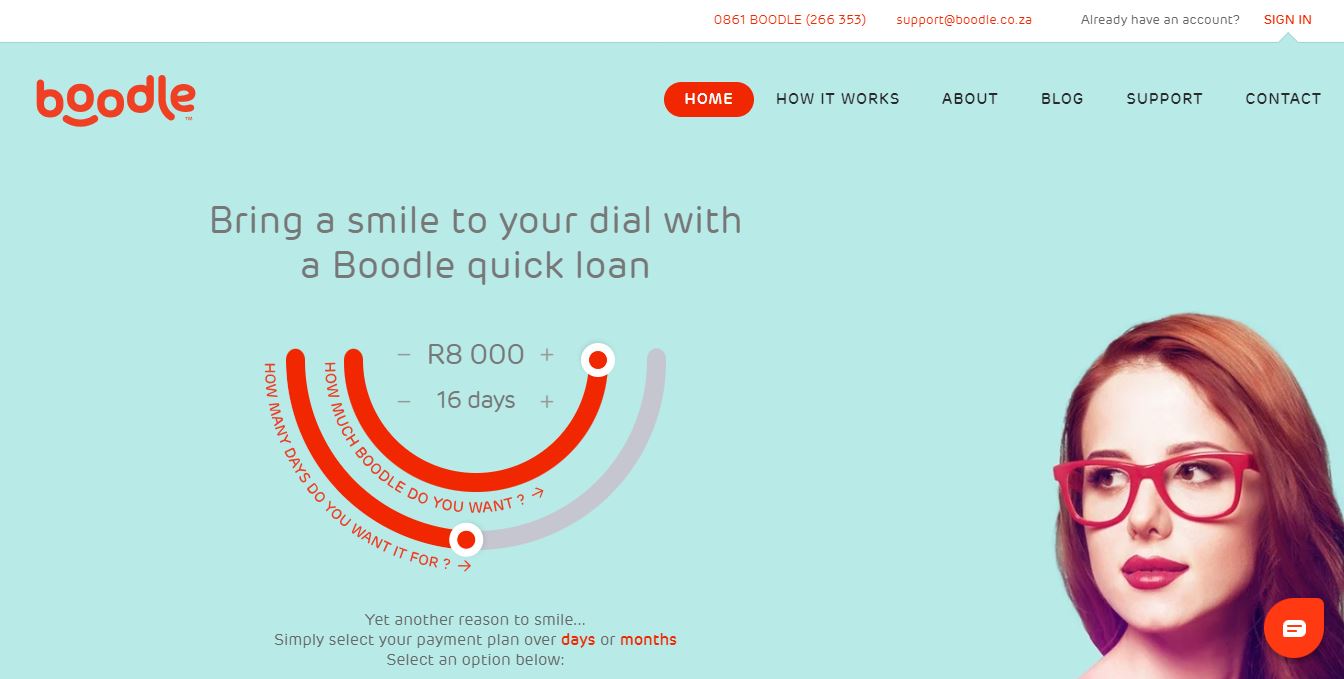

Boodle Loans

- Loans up to R8,000

- Term up to 6 months

- Interest up to 60%