Payday Loans

Get quick approval for a payday loan online, where you can borrow up to R8,000. Pay it back easily within 45 days. It’s a simple and fast solution for your short-term money needs in case of an emergency.

Get instant relief: Borrow up to R8,000 online for emergencies!

Don’t let unexpected financial challenges catch you off guard. Take advantage of our online payday loan service, and experience a straightforward, user-friendly process that puts your urgent financial needs first.

Apply today and secure up to R8,000 to navigate through unexpected situations with ease.

Explore Loan Options and Compare Rates

🧐 Understanding Payday Loans

📝 Payday loans are a type of short-term borrowing where individuals can get a small amount of money, typically to cover expenses until their next paycheck. The main purpose of payday loans is to provide quick and temporary financial relief. People often turn to payday loans when faced with unexpected expenses or emergencies.

📝 In South Africa, payday loans have gained popularity due to their accessibility and speedy approval process. Many individuals rely on these loans to bridge the gap between paychecks and address urgent financial needs.

🧐 Regulatory Landscape in South Africa

📝 The regulatory framework in South Africa governs payday loans to ensure fair practices and protect both lenders and borrowers. The rules and regulations set by authorities aim to prevent exploitation and promote responsible lending.

📝 Recent changes in regulations may impact the payday loan industry, influencing interest rates, repayment terms, and other aspects of the lending process. These changes can have significant effects on both lenders and borrowers, shaping the dynamics of the payday loan market.

📝 The regulations play a crucial role in protecting borrowers from unfair lending practices, ensuring transparency in loan terms, and establishing guidelines for responsible lending. Lenders, on the other hand, must adhere to these regulations to maintain ethical business practices.

🧐 Benefits of Payday Loans

📝 Payday loans offer emergency financial assistance to individuals facing unexpected expenses or financial crises. These loans are known for their quick and easy application process, providing a swift solution to urgent money needs. The accessibility of payday loans is particularly beneficial for individuals with bad credit, as traditional lenders may be less willing to lend to them.

📝 Payday loans serve as a short-term financial solution, and their popularity in South Africa is driven by their quick accessibility and ease of application. The regulatory landscape plays a crucial role in ensuring fair and responsible lending practices, impacting both lenders and borrowers. The benefits of payday loans include providing emergency financial assistance, a simple application process, and accessibility for individuals with bad credit.

🧐 Drawbacks and Risks of Payday Loans

1️⃣ High-interest rates and fees

One major drawback of payday loans is that they often come with very high-interest rates and additional fees. This means that borrowers end up paying back more money than they initially borrowed. The high costs can make it challenging for individuals to repay the loan promptly, leading to financial strain.

2️⃣ Debt trap concerns

Payday loans can sometimes create a cycle of debt. Because they are designed for short-term use, borrowers may find themselves needing to take out another loan to cover the repayment of the initial one. This cycle can repeat, trapping individuals in a continuous loop of borrowing and struggling to break free from the debt.

3️⃣ Impact on credit scores

Failing to repay payday loans on time can negatively affect a person’s credit score. A lower credit score can make it harder to qualify for other types of loans or financial products in the future. This impact on credit scores further compounds the financial challenges that borrowers may face.

🧐 Comparison of Interest Rates and Fees

🧐 Interest Rates

Interest rates refer to the cost of borrowing money. Different lenders offer varying interest rates for loans. It’s crucial to compare these rates to find the most affordable option. For example, a lower interest rate means you’ll pay less in total over the loan term.

🧐 Fees and Charges:

Apart from interest, lenders may impose additional fees and charges. These can include application fees, origination fees, or late payment fees. Understanding these fees is essential to avoid unexpected costs and choose the most cost-effective loan.

🧐 Comparative Analysis

To make informed choices, borrowers should compare the overall cost of loans from different lenders. This involves considering both interest rates and fees. A comparative analysis helps borrowers identify the most favorable terms and select a loan that suits their financial situation.

🧐 Application Process

🧐 Step-by-Step Guide

When applying for a payday loan, follow these steps:

- Research lenders: Compare different lenders to find a reputable one.

- Application form: Fill out the required application form, providing accurate information.

- Documentation: Submit the necessary documents, such as proof of income and identification.

- Verification: Lenders may verify the information provided.

- Approval: Once approved, review the terms and conditions before accepting the loan.

🧐 Documentation Required

Typically, lenders require proof of income, a valid ID, and sometimes bank statements. Providing accurate documentation ensures a smooth application process.

🧐 Processing Time and Approval Criteria

Processing time varies among lenders, but payday loans often have quick approval processes. Approval criteria may include a steady income and a valid ID. Understanding these factors helps borrowers prepare for the application.

🧐 Repayment Terms and Options

🧐 Repayment Periods

Payday loans usually have short repayment periods, often tied to the borrower’s next payday. It’s important to understand the terms and choose a repayment period that aligns with your financial situation.

🧐 Loan Extension or Renewal Options

Some lenders offer options to extend or renew loans, but this may come with additional fees. Consider these options carefully and only use them when necessary, as they can increase the overall cost of the loan.

🧐 Penalties for Late Payments

Late payments can result in penalties, such as additional fees or increased interest rates. Knowing the consequences of late payments encourages borrowers to meet their repayment obligations on time and avoid extra costs.

Payday Loan Calculator

🙋♂️ Lenders for Payday Loans

-

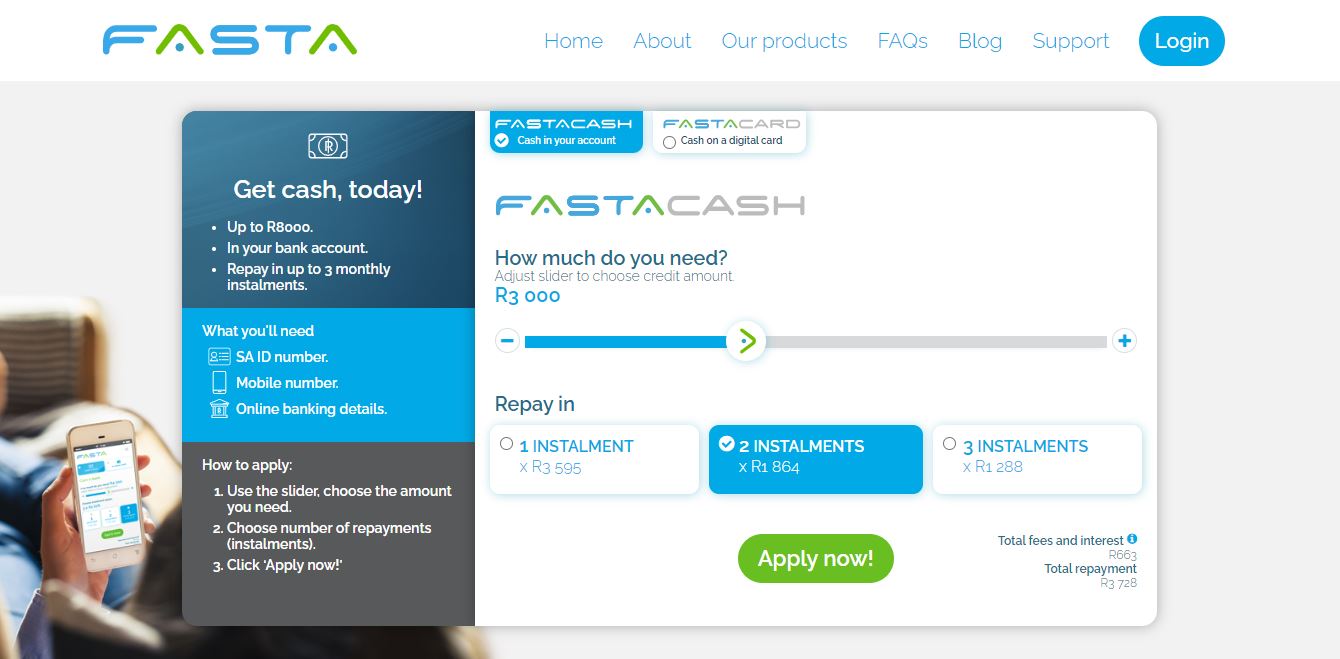

Fasta Loans

- Loans up to R8,000

- Term up to 32 days

- Approval in minutes

-

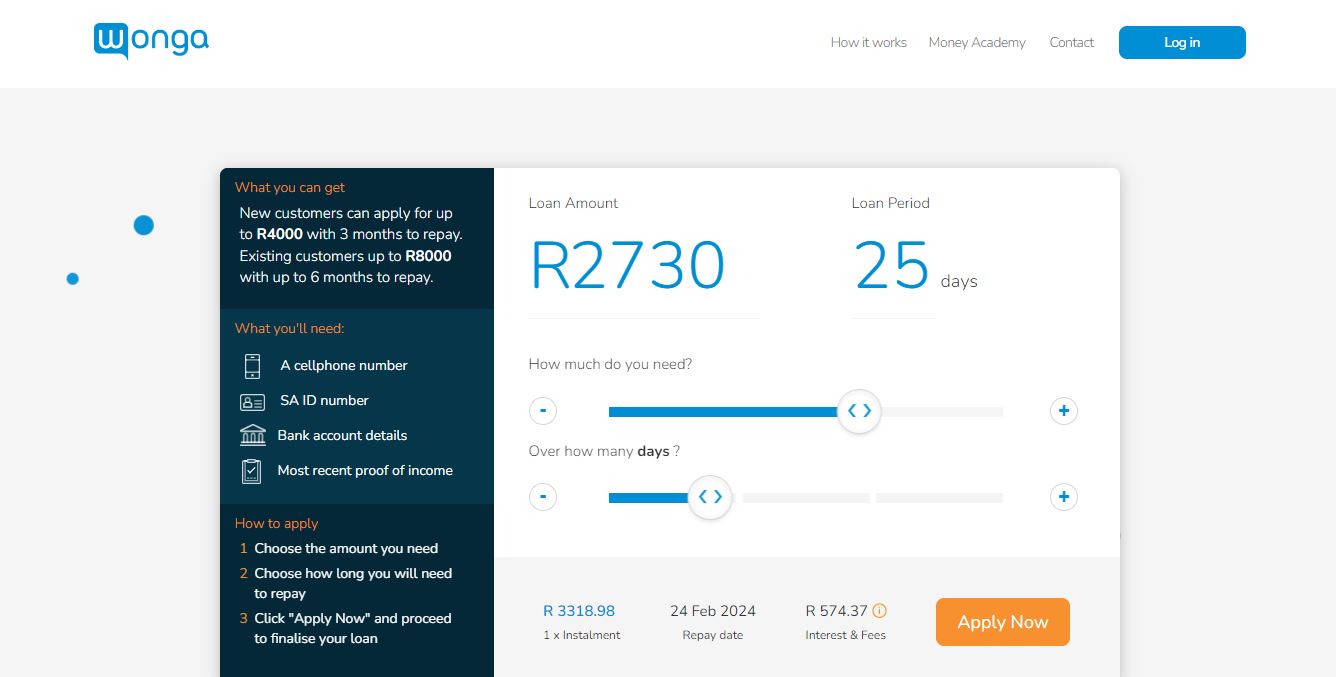

Wonga

- Loans up to 8,000

- Term up to 12 months

- Flexible interest rates

-

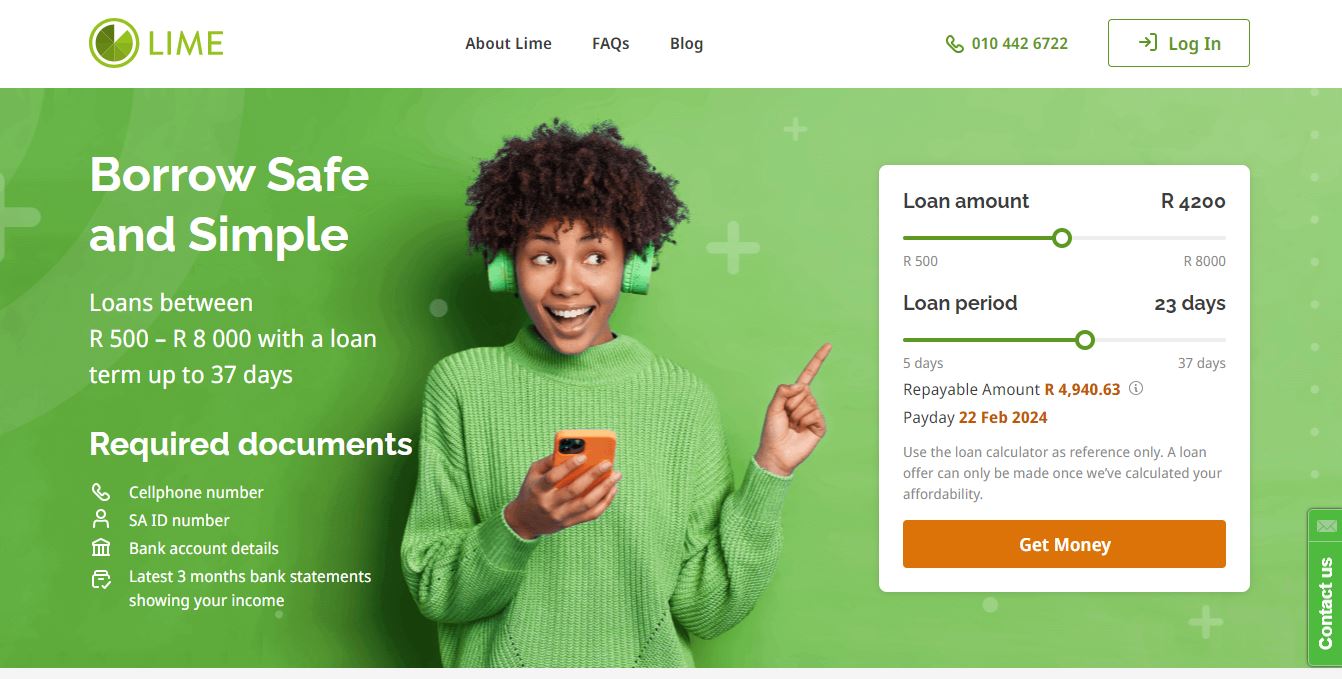

Lime24

- Loans up to R8,000

- Term up to 37 days

- Interest up to 24%

-

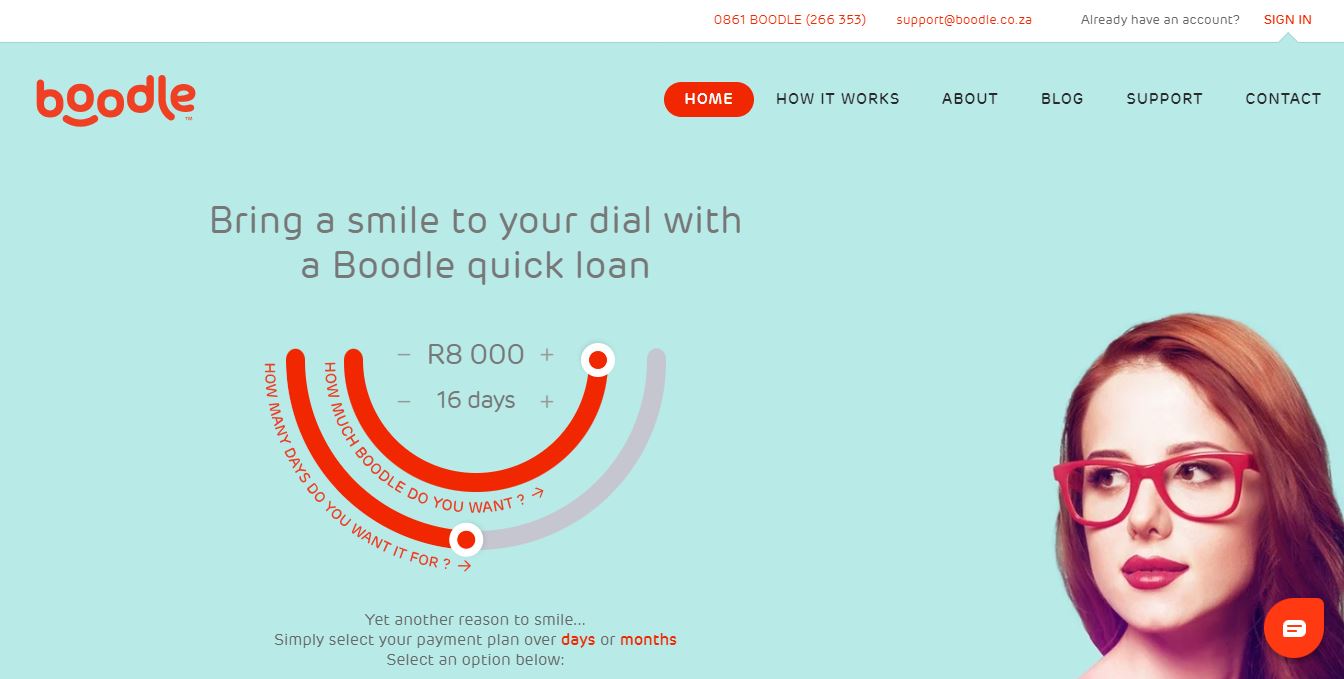

Boodle Loans

- Loans up to R8,000

- Term up to 32 days

- Interest up to 60%