Credit Cards

Discover the perfect credit card that aligns seamlessly with your unique lifestyle, unlocking a world of exclusive benefits, discounts, and rewarding experiences. By choosing a credit card tailored to your preferences, you not only gain financial flexibility but also open the door to a host of incredible perks that enhance your daily life.

Find Your Perfect Credit Card: Tailored Benefits for Your Lifestyle

With our carefully curated selection of credit cards, you can immerse yourself in a realm of rewards.

Earn points, cashback, or other enticing perks with every swipe, turning your everyday transactions into opportunities for savings and indulgence.

The more you use your card, the more benefits you unlock, creating a cycle of continuous advantages.

Explore Credit Card Options and Compare Rates

🧐 Understanding the Benefits of Smart Credit Card Use

📝 In today’s challenging economic climate, using credit cards wisely can be a strategic financial move that pays off in the long run. Explore the realm of credit cards in South Africa and learn how to make the most of them to enhance your financial well-being.

🧐 Exploring Borrowing Options in South Africa

✅ Borrowing: A Common Aspect of Daily Life

📝 Borrowing money has become an integral part of everyday life, and South Africans are no exception. By carefully planning and exercising financial discipline, individuals can leverage the benefits of borrowing money. Learn how these principles apply specifically to credit cards, one of the most widely used credit products.

🧐 Differentiating Between Short-to-Mid Term and Long-Term Borrowing

✅ Understanding Repayment Terms

📝 Explore the two main borrowing options available based on repayment terms: short-to-mid term and long-term borrowing. Short-to-mid term options include personal loans, credit cards, and store cards, while long-term options involve home loans and debt consolidation loans. Discover the increasing variety of secured personal loans, including equity release mortgages.

🧐 Using Credit Cards Wisely

📝 Credit cards operate similarly to overdrafts, allowing users to borrow up to a set limit with an interest-free period for repayment. They offer convenience and affordability, making them a practical alternative to overdrafts. Discover the best practices for using credit cards for smaller to medium-sized expenses, avoiding the pitfalls of exceeding set limits.

🧐 Applying for a Credit Card in South Africa

📝 Before applying for a credit card, compare options from different lenders, considering factors such as interest rates, fees, and interest-free periods. Improve your credit score before applying, as credit cards typically carry higher interest rates. Differentiate between store cards and bank-issued credit cards, considering accessibility, interest rates, and interest-free periods.

🧐 Using Credit Cards Responsibly

📝 Avoid the mistake of using credit cards to repay existing debt, as they often come with high-interest rates. If facing financial challenges, seek guidance from a debt counselor for better debt management. Learn the importance of maintaining a limited number of credit cards and using them wisely for occasional emergencies.

🧐 Maximizing Credit Card Benefits and Limits

📝 Explore the possibilities of increasing your credit card limit through loyalty and reliability, but be cautious of additional charges and requirements. Resist the temptation to overspend with a higher limit. Opt for alternative methods, such as direct salary transfers, to avoid unnecessary fees. Understand that credit cards may not be the ideal tool for debt consolidation or covering fixed expenses.

📝 Use credit cards as a financial tool wisely, understanding their terms and limitations. Make informed choices that align with your financial goals, keeping in mind the importance of responsible credit card usage.

🙋♂️ Lenders for Credit Cards

-

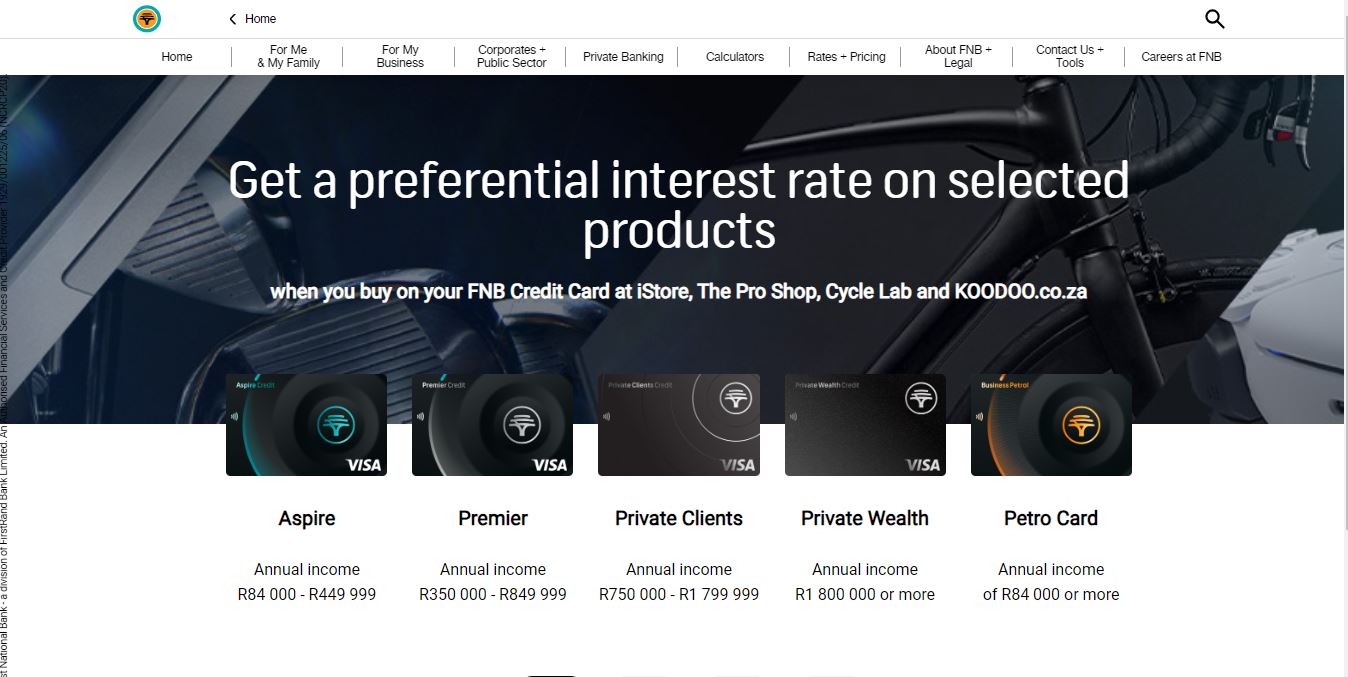

FNB Credit Card

- Credit limit up to R500,000

- Benefits No charge for Global Travel Insurance

- Build a credit history

-

Absa Credit Card

- Credit limit up to R500,000

- Benefits No charge for Global Travel Insurance

- Build a credit history

-

Woolworths Credit Card

- Credit limit up to R500,000

- Benefits No charge for Global Travel Insurance

- Build a credit history

-

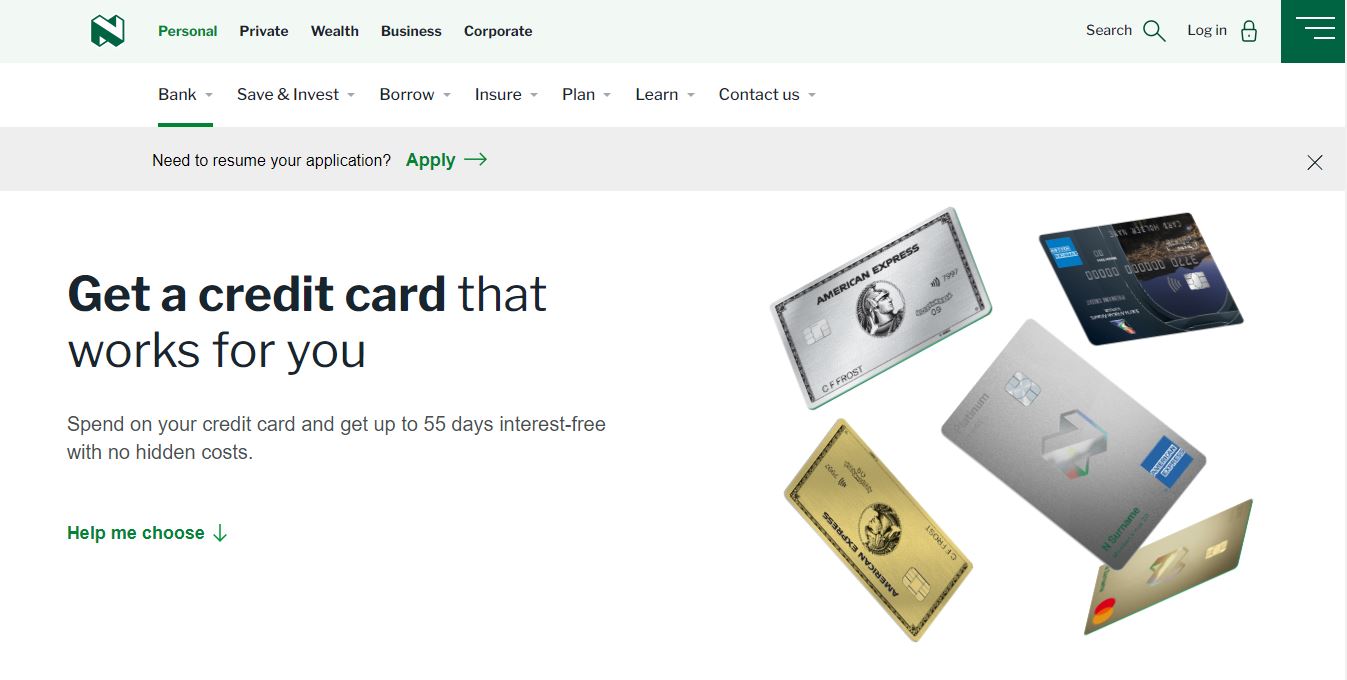

NedBank Credit Card

- Credit limit up to R500,000

- Benefits No charge for Global Travel Insurance

- Build a credit history