Loans for Bad Credit

If you’ve been blacklisted or have bad credit, these lenders are here to provide you with a range of alternative loan products. Despite past credit issues, you can still secure a loan of about R250,000.

Loans for Those with Less-than-Perfect Credit: Apply Online Now!

A short-term loan is money you can borrow to help with things like paying bills or buying groceries.

You can get this money quickly, often on the same day you apply. And the best part is, you can do it all online without much hassle.

Explore Loan Options and Compare Rates

🧐 Discover Personal Loans in South Africa, Regardless of Credit Status

📝 If you’re facing financial challenges and have been blacklisted, we’re here to guide you towards suitable financial options. In South Africa, even with a less-than-perfect credit score, our assistance can help you secure a loan and work towards improving your credit standing.

🧐 Tailored Loans for Bad Credit Situations

📝 Specialized loans designed for individuals with poor credit histories are available online. While these loans may come with higher costs compared to traditional options, they provide an opportunity for those with bad credit to access the funds they need.

🧐 Understanding Bad Credit in South Africa

📝 To navigate bad credit effectively, it’s crucial to understand your credit standing. Requesting a free annual credit report is your right and helps identify any errors or fraudulent activities that may impact your credit history.

🧐 Explore All Options for Personal Loans

📝 Having bad credit doesn’t mean you’re ineligible for a personal loan. While traditional banks may have stringent requirements, alternative lenders catering to bad credit individuals offer viable solutions. Ensure you apply to registered credit providers following the National Credit Act guidelines to avoid potential pitfalls.

🧐 Government Support and P2P Lending

📝 Government programs and local initiatives support individuals with bad credit, providing assistance for emergencies, home improvements, or starting a small business. Additionally, peer-to-peer lending platforms offer direct access to loans without traditional credit providers, though responsible repayment is essential.

🧐 Alternative Avenues for Bad Credit Loans

📝 Consider approaching friends or family for financial support or co-signing a loan. Creating a clear agreement and ensuring transactions are documented can make this a viable option. Securing a loan with collateral is another route, offering better chances and potentially lower interest rates.

🧐 Caution and Practical Tips

📝 Before committing to any loan, understand the costs, installment amounts, and overall repayment terms. If the financial burden seems overwhelming, explore alternative solutions and avoid accumulating more debt unless guided by professional debt consolidation or credit counseling services.

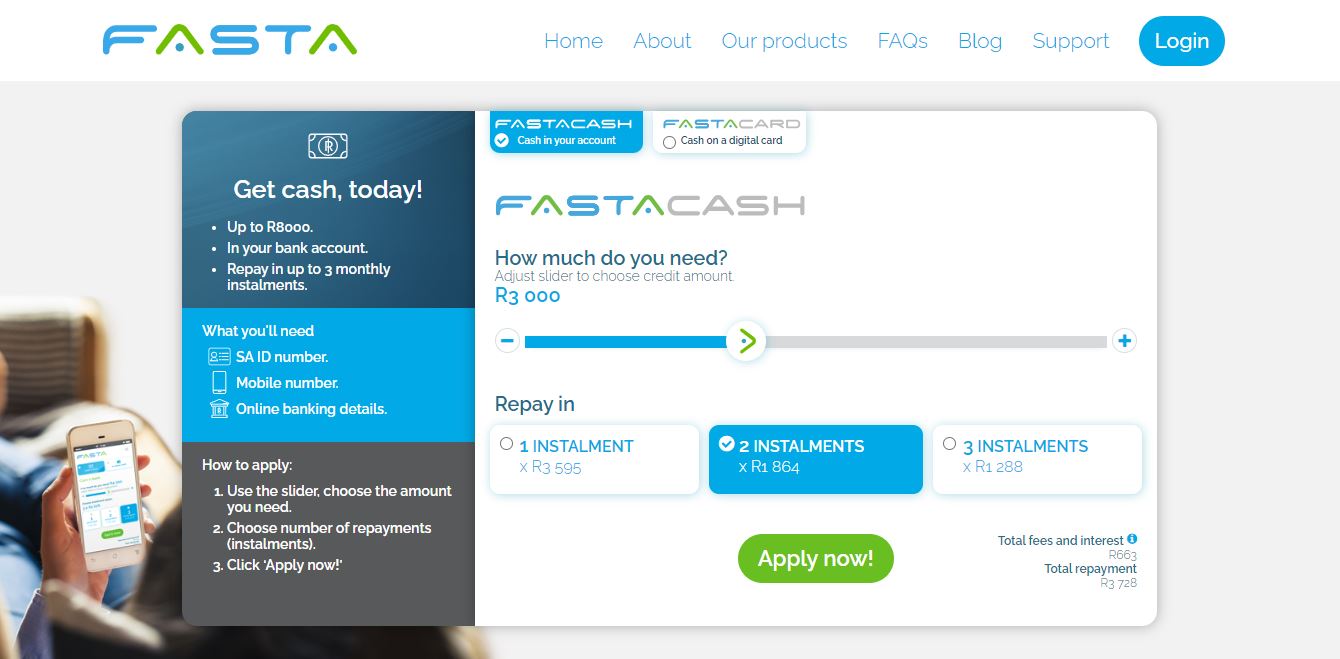

Bad Credit Loan Calculator

🙋♂️ Lenders for Bad Credit Loans

-

Mulah Loans

- Loans up to R8,000

- Term up to 3 months

- Interest up to 38%

-

Hoopla Loans

- Loans up to R250,000

- Term up to 60 months

- Interest up to 20%

-

EC Loans

- Loans up to R120,000

- Term up to 84 months

- Interest up to 28%

-

EZI Finance

- Loans up to R8,000

- Term up to 6 months

- Interest up to 32.1%